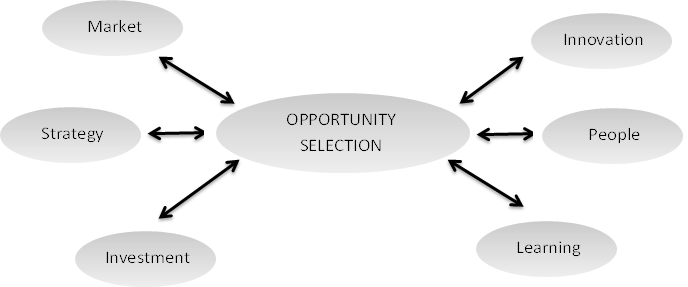

Opportunity selection model

Source: David Rae, Entrepreneurship, published 2007 [PALGRAVE MACMILLAN] reproduced with permission of Palgrave MacMillan.

|

High-value Opportunity |

Market |

Low-value opportunity |

High-value opportunity |

Innovation |

Low-value opportunity |

|

|

Able to access market of growing size and value |

Market growth |

Limited growth potential in smaller markets |

Able to lead the market using prior experience |

Innovation leadership |

Learn as you go along to catch up |

|

|

Known, identifiable customers in defined market sector |

Customer base |

Limited or non-specific customer base |

Application solves a problem informed by customers’ needs |

Innovation related to customer needs |

Application does not solve customers’ real problem |

|

|

Customer reliance on product increasing over time |

Customer reliance and convergence |

Customer not reliant on product, divergent from their needs |

Differentiated technology; optimal performance and cost benefits |

Technology differentiation |

Undifferentiated technology; marginal performance and cost improvement |

|

|

Trust and open rela-tionships with clients; compatible practices |

Customer interaction |

Adversarial customer relation-ships; lack of fit |

Strong IP protection with clear ownership and control, hard to copy |

Intellectual property |

Weak or no IP protection – can be copied |

|

|

Long-term partner-ship within strong supplier and technology networks |

Partnering and networks |

One-off relation-ships within weak networks |

Opportunity to be first to market |

Speed to market |

Follower to market |

|

|

Unique advantages and strengths apparent in relation to competitors |

Competition |

Undifferentiated from competitors, forced to compete on price |

Implementation feasible; challenges can be overcome |

Feasibility of implementation |

Difficult to implement with many obstacles |

Opportunity selection model

|

High-value Opportunity |

Strategy |

Low-value opportunity |

High-value opportunity |

People |

Low-value opportunity |

|

|

Have a strategy to create and grow business |

Business growth |

Limited purpose and scope to build a business |

CEO shows leader-ship in innovation |

CEO leadership |

CEO not an innovative leader |

|

|

Multiple strategic and exit options |

Strategic options |

Single or limited exploitation options |

Management team skilled, compatible and motivated to achieve |

Management team effectiveness |

Team lack management skills fit and motivation |

|

|

High value creation from high profit margin and cash generation |

Value creation |

Low perceived value and profit margin |

Able to use prior experience and knowledge of industry |

Contextual experi-ence |

No pre-knowledge of industries or technology |

|

|

Superior business model |

Innovation business model |

No advantage over existing business models |

Able to recruit experienced people from within industry |

Staff capability |

Experienced and capable staff not available |

Opportunity selection model

|

High-value Opportunity |

Investment |

Low-value opportunity |

High-value opportunity |

Learning |

Low-value opportunity |

|

|

High return and profitability in rela-tion to investment |

Investment reward |

Low financial return for investment |

Independent control of business |

Independent control |

Not in full control of the business |

|

|

Attractive to potential investors with growing equity value |

Investor attraction |

Unattractive to investors offering limited increase in equity value |

Personal vision and confidence in busi-ness potential |

Personal vision |

Self doubt and lack of scope to succeed |

|

|

Acceptable risk of loss in worst case scenario |

Risk |

Unacceptably high downside risk |

Able to reduce margin between success and failure |

Incremental learning |

Unable to reduce margin of effectiveness |

|

|

Commercially viable with predictable break-even and cash flow |

Viability and cash flow |

Unpredictable cash flow, unlikely to achieve viability |

Intuition, knowing the right thing to do |

Intuition |

Does not feel right - bad past experience |

|

|

Long-term opportunity and income stream |

Timescale |

Short-term time-frame and rapid exit strategy |

Able to practise ethical framework and values |

Ethics |

Non-ethical exploitation |

Opportunity selection model

Scoring

| Market | Inovation |

| 6 factors total: |

6 factors total: |

| Strategy | People |

| 4 factors total: |

4 factors total: |

| Investment | Learning |

|

5 factors |

5 factors total: |

| 30 factors Total for all 6 clusters |

Score

| 0-7 | Likely to be a low-value opportunity with limited return, if all have aspects been explored suggest disregarding it. |

| 8-15 | Moderate-value opportunity, can aspects with growth potential be developed? |

| 16-24 | Worthwhile opportunity; needs careful analysis to improve weak areas and raise the value potential. |

| 25-30 | Strong potential for a high-value opportunity; beware of over-optimism. Explore in detail the weak areas, potential competition and feasibility; plan to implement |

Whatever the score, look carefully at the low-value clusters (scoring half or less) and explore how these could be increased.

Write the cluster score on the diagram overleaf:

Ways of increasing opportunity value:

Market

Innovation

Strategy

People

Investment

Learning